Investing in Software vs. Real Estate

Investing in mature software businesses is not too different from multi-family real estate

As I hit the one-year mark at Constellation Software, I've learned a few lessons (with a lot more to go) when it comes to investing in mature software businesses.

One lesson is the fact that:

It may seem a bit ridiculous on the surface but the reality is that the way I look at software businesses is quite similar to the way I'd look at income properties.

Here's a quick outline:

Rent Roll vs. ARR

This is probably the most obvious one. In software, you should take a look at the composition of your recurring revenue and understand how it's changed over time (organic growth, new customers, attrition, concentration with a certain number of customers).

Similarly, in real estate, you should look for how often tenants change, concentration risk with a certain group of tenants, and the overall pricing levels relative to the rest of the market.

Attrition vs. Vacancy

In software, your customers are everything. As an investor, you want to understand how happy your customers are and what their profile looks like. Products that serve the SMB space are more likely to have higher attrition vs. ones that serve the government/banks.

Similarly, in real estate, you should spend a lot of time understanding the tenants that are already in place. A rental building that focuses on students has a very different turnover/vacancy rate vs. one that serves families.

Product Stickiness vs. Location/Condition of Building

In software, we're always trying to understand how important the product is to the actual operations of the business. Generally speaking, an inventory/warehouse management system is far more 'mission-critical' than an employee survey software. As an investor, it's far less risky to make long-term bets on products that almost never get switched out.

In real estate, the bulk of the value comes from the location. The ability to be close to a city center, key transportation routes, schools, and employment can make a massive difference in the 'stickiness' of your building. All things equal, you want to invest in properties that have the best location possible.

Product Management vs. Property Management

This is by far one of the more obvious commonalities. When you're looking at a software business, you want a management team that understands the industry/customer and knows how to operate a software business. In real estate, this is equivalent to understanding the area/tenants while being able to deal with smaller operational issues (e.g. repairs/maintenance and finding new tenants).

Software Rewrites vs. Renovations

They both represent an incredible amount of risk for the investor and are usually more expensive and take longer than expected. You should price these type of investments accordingly.

Cash Flows

Financially, it's inevitable that you're looking at both businesses in a very similar way. If you're looking to own mature software businesses or rental properties, you're constantly focused on optimizing on the percentage of cash flows in addition to the predictability of cash flows. From this perspective, software businesses offer a bit more flexibility as you maintain the product using internal resources (management/development team) vs. using external resources (e.g. contractors) in real estate.

Returns

When you compare unlevered returns, there is no doubt that software businesses (even today) have a better profile than real estate.

Here's a look at where software companies are at today. With these multiples, it's not uncommon for low/moderate growth software assets to trade between 15-25x EBITDA.

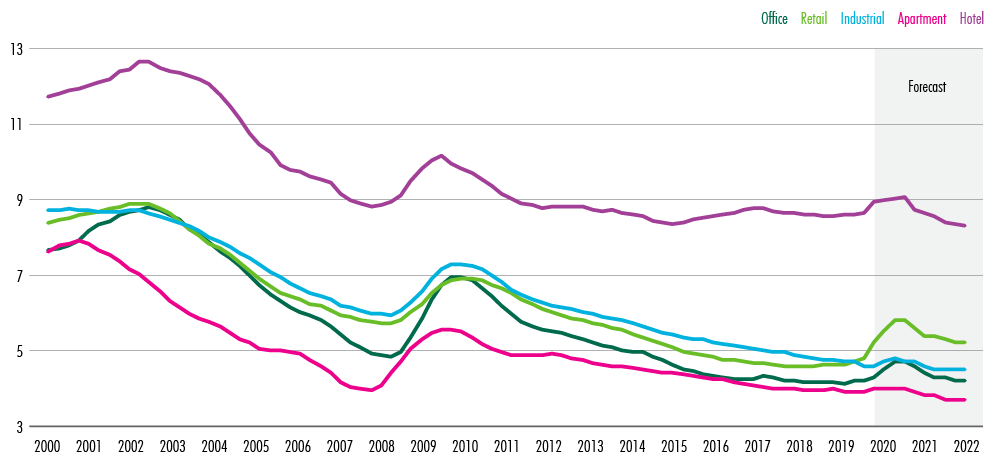

Now, let's compare this to real estate. We've now become quite accustomed to seeing cap rates range between 3-5%. This creates an implied EBITDA multiple of 20-33x. The main reason why the market finds this acceptable is because we've created an economic system that relies on our ability to significantly borrow against real estate.

Outlook

Both software businesses and real estate can be great investments. My post above (especially the section on unlevered returns) isn't meant to guide people one way or the other. If you have the ability to invest in both, I'd recommend investing in both software and real estate.

However, I will say that the days of rapid price appreciation in both software and real estate are fairly limited because interest rates and real economic growth are more likely to go up vs. down. While there will always be outliers (especially in technology and perhaps specific real estate markets), I suspect returns among mature assets will be determined by its ability to drive organic/inorganic growth.

While I'm obviously biased, I believe that this creates an interesting buying opportunity in the market for investors (e.g. Constellation Software) who already have a stable source of cash flows (from existing software assets, investment properties, or operating income) with minimal leverage. From this perspective, I believe that it’s easier to invest globally when it comes to software vs. real estate.

https://perpetualincomeinvestor.substack.com/