Origination #75

How to generate opportunities and deals, thoughts on inflation, IG's growth story

Origination

In some ways, you can argue that I only got into the world of origination (sourcing deals) since joining Constellation Software.

I don't see it that way.

All of us have had to do some origination work at some point in our lives. Here's a few examples:

Looking for a job

Buying a house (or any other non-trivial purchase)

Searching for your life partner

Looking for investments

Finding the next meme stock

Any time you're faced with a situation where you have limited resources (usually money or time) in a world of endless possibilities, your origination skills are at work as we're all wired to select the option with the best value (monetary and non-monetary).

From this perspective, I've been doing origination for a while now.

While I don't consider myself to be an expert, I've learned some invaluable lessons along the way - especially in my current role as corporate development/M&A.

Maintain Volume

The more people you reach out to and the more relationships you build, the more opportunities you're likely to come across. From this perspective, there is really no substitute for hard work. However, there are certain cheat codes that can fast track your ability to efficiently use a high-volume approach:

Follow Up: Persistence is a trait that can be incredibly valuable. Relationships can be built by simply staying in touch once or twice a year. The key to enable this is to be organized and set the appropriate reminders.

Automation: Once you have a fairly repeatable pitch to an audience that behaves similarly, it's time to automate your outreach/relationship development. There are a number of tools that sit on top of most communication platforms (e.g. email, LinkedIn, cold calling/voicemails) that can do the work for you. At the very least, you can outsource the work to a cheaper resource.

Communities: By creating, joining, and providing value in communities, you can increase your exposure to potential opportunities.

Consider Everything

The more limitations you place on yourself at the point of outreach - the less likely you'll find the special opportunities. Whether it is about finding jobs or potential investments, you should aim to apply/reach out everywhere.

If you need a rule of thumb, it's often best to look where no one else is looking. In software M&A, the 'easy' approach is to simply participate in broker-led processes. While the vast majority of opportunities are led by a broker, it's also safe to say that you're more likely to compete with 15+ other buyers. Real estate has a very similar dynamic. However, value is created when you're able to bypass all of that and participate in a sales process where you don't have any other competitors.

Know Your Criteria

There's a catch when it comes to considering everything. You need to be able to disqualify just as quickly. Your ability to disqualify opportunities is the best measure of focus. A lot of people focus on the 100+ acquisitions that Constellation buys every year or the number of houses that real estate investors purchase or even the number of job offers that an individual can receive.

I think it's far more valuable to understand how people disqualify opportunities. I'll admit the hardest part of my job is to continue to considering everything while disqualifying the vast majority of the opportunities I source. It's a complete paradox but a big part of being a productive investor.

Prioritize on Speed

When it comes to origination, time is your most valuable resource. When you're looking for opportunities, here's how you can waste your time:

Looking in the wrong areas. It sounds obvious but many of us spend time exploring "what if we did _________ "

Rejecting opportunities slowly. Despite knowing your criteria and understanding that there's an 80% chance that a deal won't work, it's still tough to say no right away vs. spending some time to consider it. This is especially true among smart, entrepreneurial people who believe that they know more than most.

Getting to the details too soon. Diligence is very important but only toward the end of the process. By considering the details too soon, you often end up getting distracted with aspects of an opportunity that don't really matter.

Uneven Inflation

This is a great post that I found on Twitter. It explains what I have been thinking about for a while re: inflation.

Here are @balaji's thoughts on what's going on.

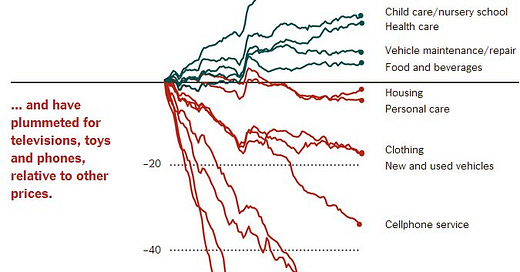

1) The inflation is already here, it’s just not evenly distributed

2) High valuations and lots of paper wealth created, but real incomes for many Americans stagnating

3) Economy is a tug of war between state inflation and technological deflation

The number of people who'll be able to generate income that outpaces the inflation we're seeing in various asset classes is reducing rapidly. The graphic (while old and perhaps a bit inaccurate in the case of housing) explains the uneven inflation we've experienced.

How We Took Instagram To A Billion Users

This interview with Instagram's co-founder Mike Krieger and Sriram Krishnan is worth a look. It goes into how Instagram thought about growth during its early days and everything that's happened since. It's only 20 minutes long and worth the listen.

WallStreetBets

$GME and a few other highly shorted stocks appear to have captured the interest of many. The All-In Podcast captures the different viewpoints better than most. Check it out!

Thanks again for reading this week’s newsletter. If you can just comment on what you think is interesting, what you find confusing, and what you think is boring or irrelevant, that would be really helpful.

Until next week,

Suthen