Investor vs. Broker Mindset; Roll-Ups #105

Diving into the idea of having an investor vs. broker's mindset; the challenge behind roll-ups

Before delving into the idea of having an investor's mindset vs. a broker's mindset when buying assests. It's important to provide some context.

This is a great thread by 10-K Diver on the relationship between asset prices, inflation, and interest rates.

If I had to leave you with one chart from the thread, it would be this one.

A lot of investments/acquisitions have been made with the assumption of a low inflation and a low real rate of return environment. While we'd like to believe that assets have become more valuable over time, the reality is that the increase in asset values have largely been driven by a low interest rate/inflation environment as well.

As an investor, this is what makes the next 12-24 months interesting. The constant increase in asset prices (inflation) along with a pending increase in interest rates can drastically impact how we value many of our businesses today.

The uncertainty of what could happen in the future along with prices being reaching all-time highs has created an extremely active M&A market. Anecdotally, when speaking with M&A advisors, everyone seems to be busy working on a record year with very little insight into how next year will turn out.

Many founders/investors exiting their business today have had the fortune of operating in an environment where interest rates/inflation have become more favorable over the course of their journey (e.g. the past 5+ years).

It'll be interesting to see how today's cohort of investments perform over the next 5+ years. I suspect that there will be a lot more pressure to improve operational metrics assuming that interest rates/inflation become less favorable over time.

In theory, this could create situations where 'distressed' assets emerge and businesses cannot perform up to the standards to justify their initial investment/acquisition price.

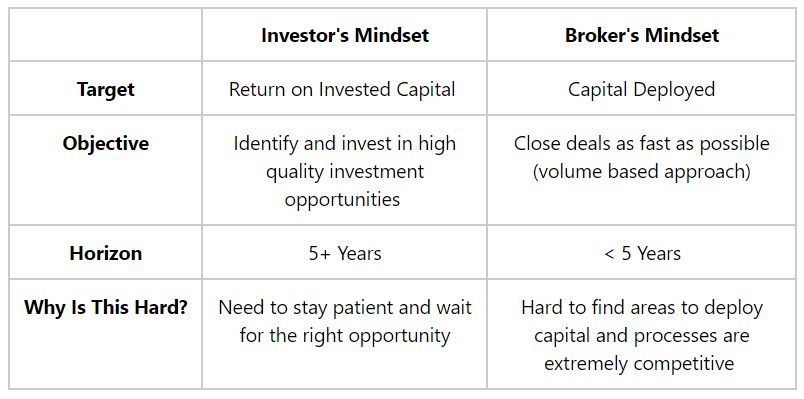

Personally, this creates a dilemma between what I'd call as having a 'broker mindset' where we try to close as many deals as possible vs. an 'investor mindset' where we stay disciplined on the investments we make.

If you look at the past 5-10 years, people who have had a broker mindset have done quite well. It didn't really matter which asset in particular you bought, however the more that you bought, the more returns you generated.

Those with an investor mindset (particularly value investors) were unfairly punished (relatively speaking) as they took a more prudent/patient approach with the belief that rates would adjust 'back to normal' again.

Here's how I would compare/contrast the two approaches:

While this could be wishful thinking, I suspect that there will be a reversal (assuming inflation/interest rates go up) where those with a broker mindset can ultimately be unfairly punished vs. those with an investor mindset.

Roll-Ups

I've previously written about roll-ups before. I found this video to be quite interesting to watch as it focuses on the challenges/opportunities that come up during the due diligence stage in PE (skip over to 32:45).

The focus on managing due diligence is an aspect of M&A that I didn’t quite appreciate before. As you working on larger deals, you’re often run in a position where you’re simultaneously participating in a process while running one yourself (e.g. raising debt).